The meteoric rise of Hopin...

Hopin's rise was stratospheric... 🚀 Indeed it became the fastest-growing European tech startup of all time in March 2021 when it hit a $5bn valuation in just one year and nine months. A few months after that they raised another $450m in Series D funding, valuing the company at $7.75bn. Impressive stuff.

Recent troubles

But recently things have been looking less rosy: Hopin cuts 29% of its staff, just months after its last layoffs and Inside Hopin: how Europe’s fastest growing start-up lost its way

Could a community of event professionals' conversations have predicted this?

In early 2020, just as the UK was going into its first lockdown, we at Guild set up a community for event professionals. It was called CREO, now Events 365, which stood for Coronavirus Response for Event Organisers and it quickly gained over 1,000 members from around the world, eagerly sharing and learning from each other as they had to pivot to virtual events.

18 months later we worked with Wordnerds to analyse the conversations in the CREO community to see what insights we could mine - both quantitative and qualitative (including sentiment analysis).

What did this analysis teach us? And could it have predicted the journey Hopin were about to go on...?

Community insights into language and sentiment

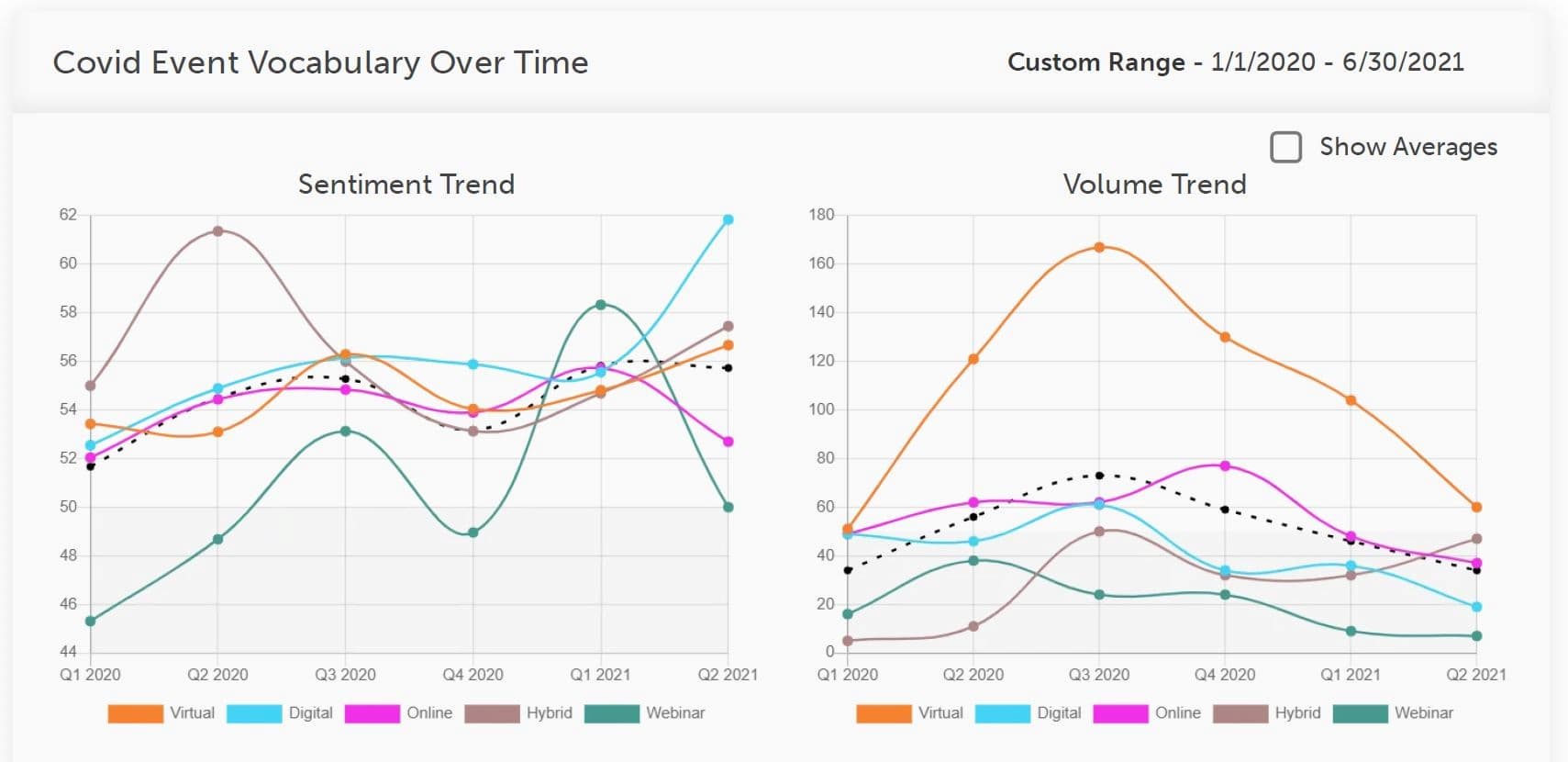

Communities are like an unobserved focus group where you get to understand what the market thinks, wants, their pain points, emerging trends etc. But it's also super useful to learn what language is most common and how positive/negative the market feels about key topics and themes.

Below shows what kinds of events were being talked about most in the Events 365 community, but also how positive event professionals felt about them. You can see the rise of "virtual" and the demise of "webinar" for example.

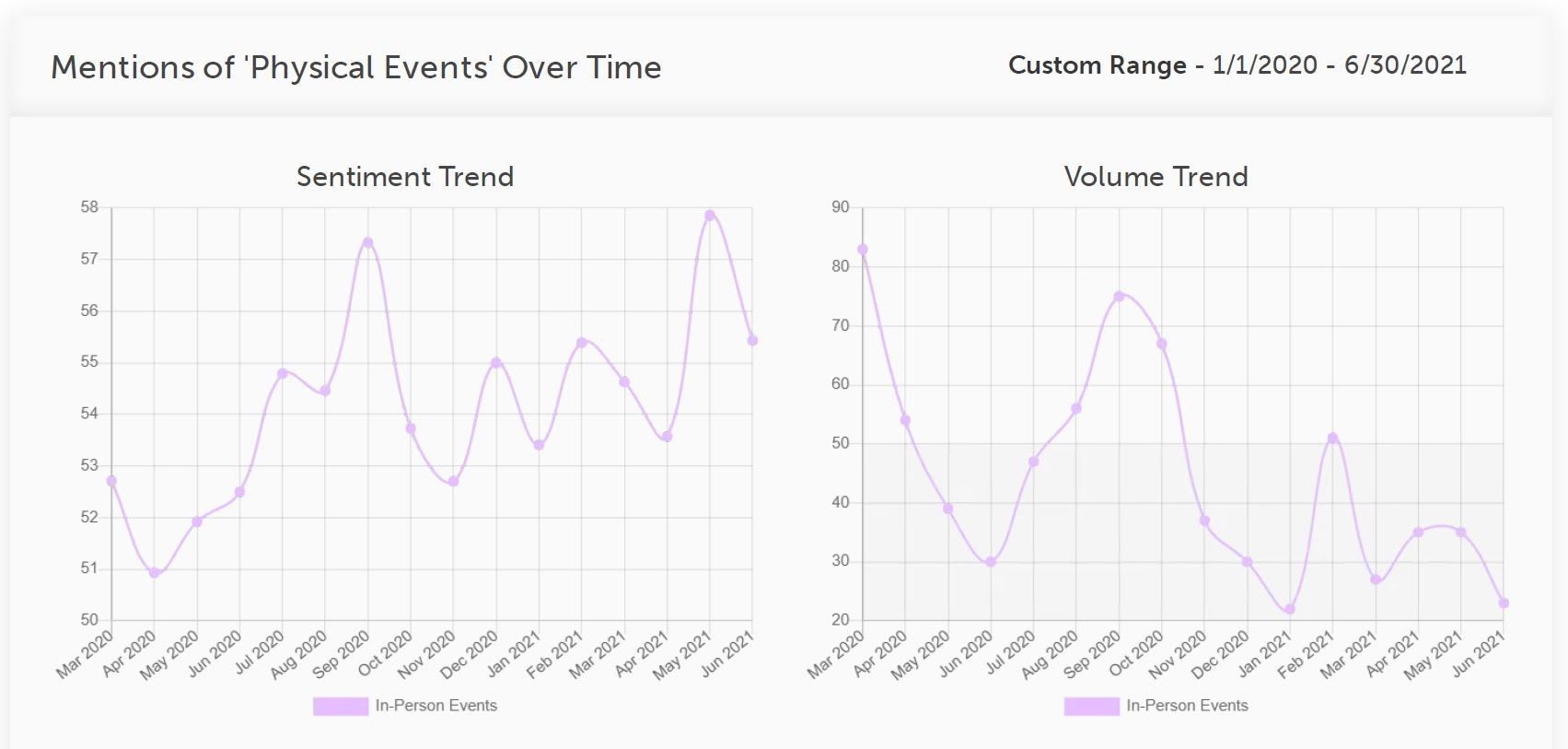

And the following shows that whilst in-person physical events weren't being talked about much in mid-2021 (they weren't really possible because of Covid) the event organisers felt very positively towards them. Certainly now that in-person events are back, a lot of event organisers say how much they have missed them.

A community-generated vendor leaderboard

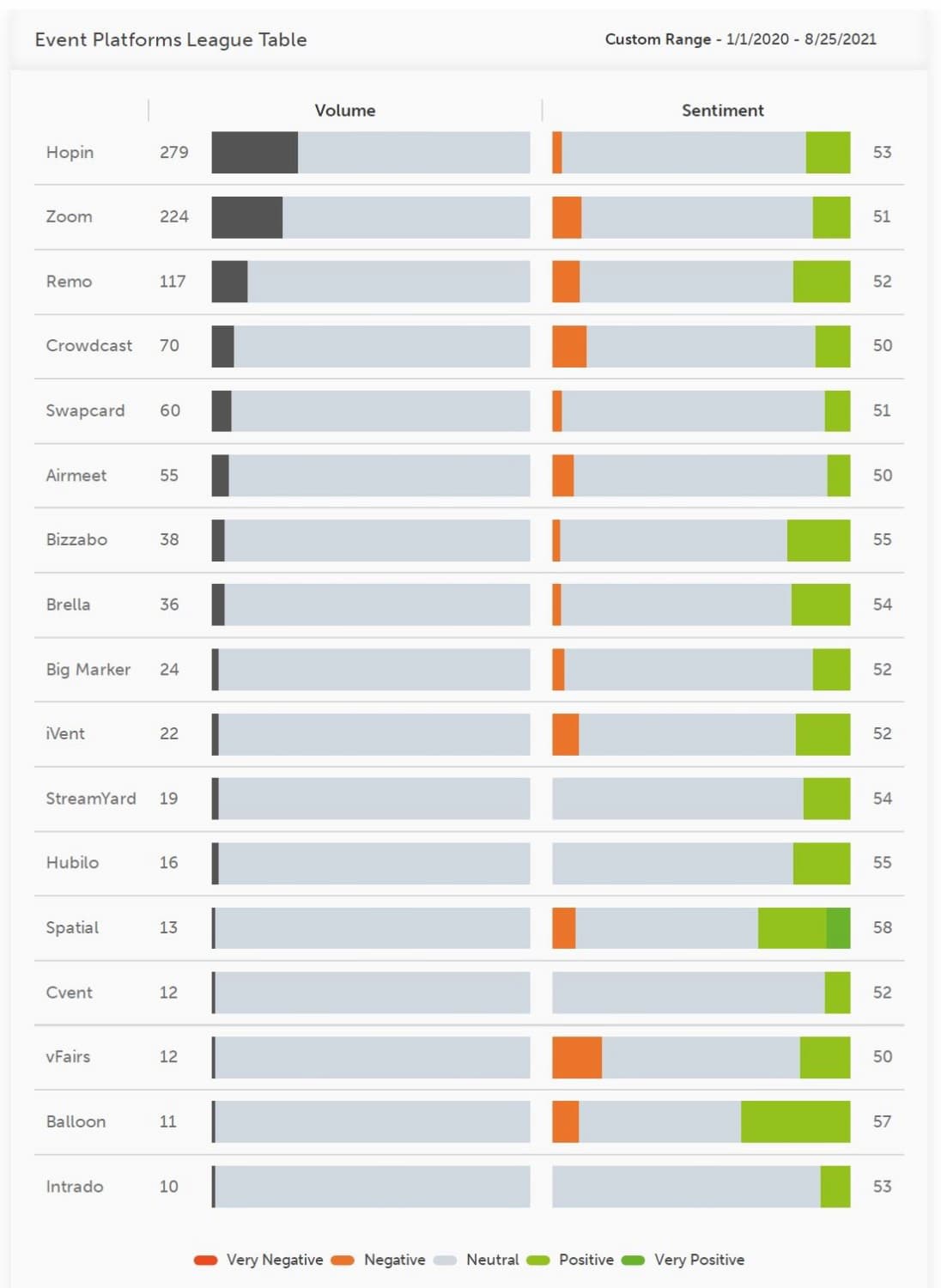

The Events 365 community, consisting of event organisers rather than vendors, is an amazing way to see what the buy-side actually think about all the various event tech vendors. So we analysed the conversations to see who was most talked about but also how positive/negative the comments about them were.

Just from organic conversations, we were able to produce the leaderboard below which surfaced Hopin, Zoom, Remo, Crowdcast, Swapcard, Airmeet, Bizzabo, Brella, BigMarker, iVent, StreamYard, Hubilo, Spatial, Cvent, vFairs, Balloon, Intrado.

You can see how successful Hopin was in creating buzz and conversation in the community - more talked about than Zoom even. But you can also see on the sentiment that there were negative comments and their positive sentiment wasn't as strong as other vendors.

What did the event organisers like and dislike about Hopin back then?

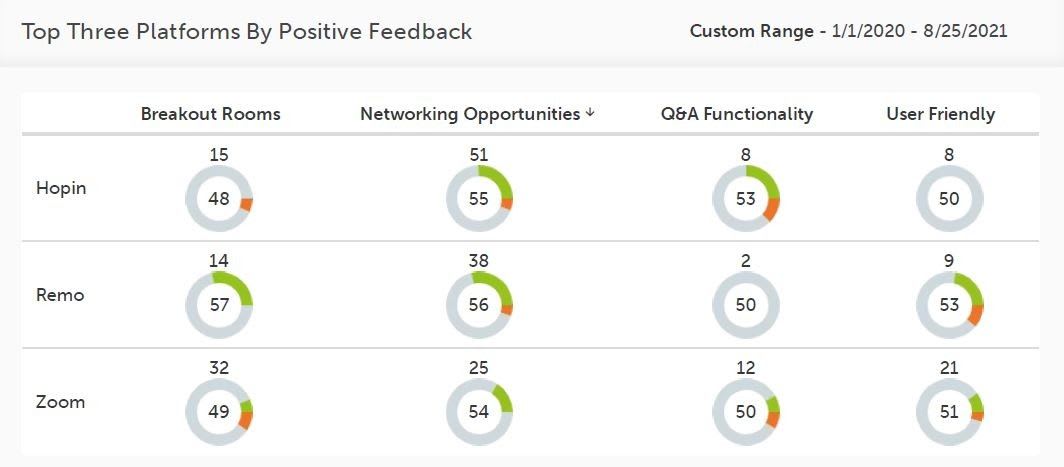

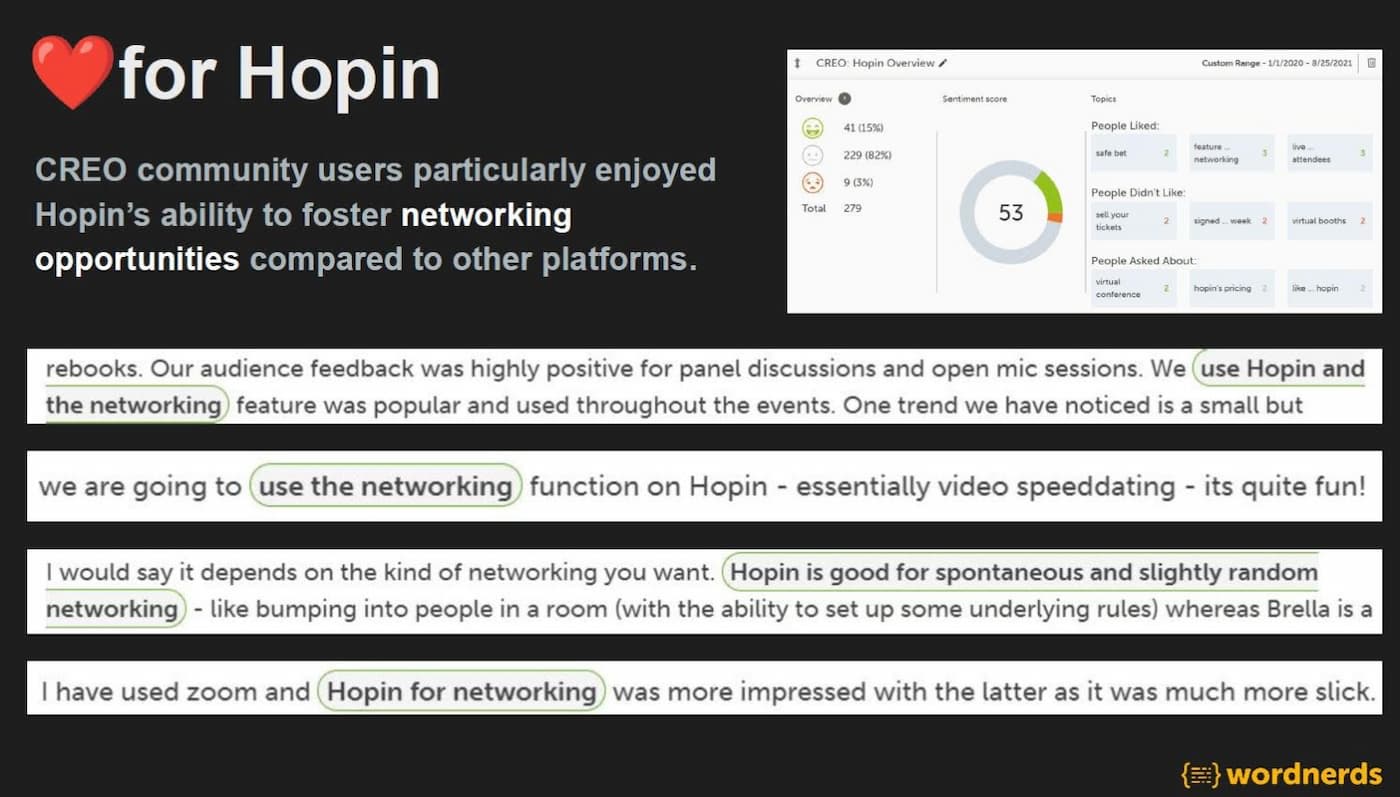

For all of the vendors above, we could deep dive into the sentiment analysis to see what exactly the event organisers felt was positive or negative about that vendor, and see the exact phrases used.

For example, below we have further analysis on Hopin - at the time event organisers were really positive about Hopin's networking feature but they were not so impressed with the virtual sponsor booths. And they asked a lot about Hopin's pricing.

Could these community insights have predicted the future?

It would have been easy to predict Hopin's rise certainly. And it would no doubt have helped Hopin to know where they were falling down on product features or pricing. And you could have said that Hopin's subsequent acquisition of StreamYard was a smart move given how positively the community felt about them.

This analysis only covered the 18-month period from 2020 to mid-2021, so too early really to have predicted Hopin's recent challenges (which, arguably, are also part of wider changes in the tech market). But even a fairly superficial view shows that Hopin certainly weren't the best-loved of the vendors, even during their crazy ascendancy, by the actual buyers in the market, so perhaps Hopin's journey was also a triumph of PR and marketing rather than product? Hubilo scored a lot higher on positivity for example but didn't get to multi-billion dollar valuations.

What new community intelligence is there into the trends around events?

We need to re-run the analysis on the community conversations over the last year to be sure. But, if you're an event organiser, why don't you join the conversations and networking in our Events 365 community and you can see for yourself.

And if you're interested in how online communities work and how you can use them to gain unique insights into your market, then we at Guild would love to talk!

Photo by Sindre Strøm from Pexels

Try Guild 🤝

See for yourself how the Guild experience is different to WhatsApp, Slack, LinkedIn or Facebook Groups.

Guild is a safe space to connect, communicate and collaborate with others.

Join us on a platform that is purpose-built for creating groups, communities and networks on mobile.

- Just want to join some groups? Simply join Guild and then look through the discoverable groups and communities to find relevant ones to join

- Thinking of running your own community? With an elegant and simple to use, mobile-first UX you’ve got everything you need to start a community - custom branding, analytics, group and user management and support. Get started with your own community here with our free and paid options

Contact us if you want to know more or have any questions.